Does China dominate the world in cellular-based IoT? If figures are to be believed, China accounts for more than three-quarters of all cellular-based IoT connections. We at Transforma Insights have been doing some digging. Let’s take a look at the results.

“If figures are to be believed, China accounts for more than three-quarters of all cellular-based IoT connections.”

-Transforma Insights

China Leads in IoT Connections

In total, the three big Chinese telcos claimed almost 2.5 billion IoT connections at the end of 2022. That compares to about 707 million connections for the 35 biggest operators outside of China (Vodafone, AT&T, etc.). They probably account for 95 percent of global operator connections.

We think that figure for the three operators should be closer to 1.5 billion, allowing for differences in definition and a few other factors. But that’s still 2/3 of global cellular connections, dwarfing even the biggest groups from around the world.

IoT Revenue Is a Different Story

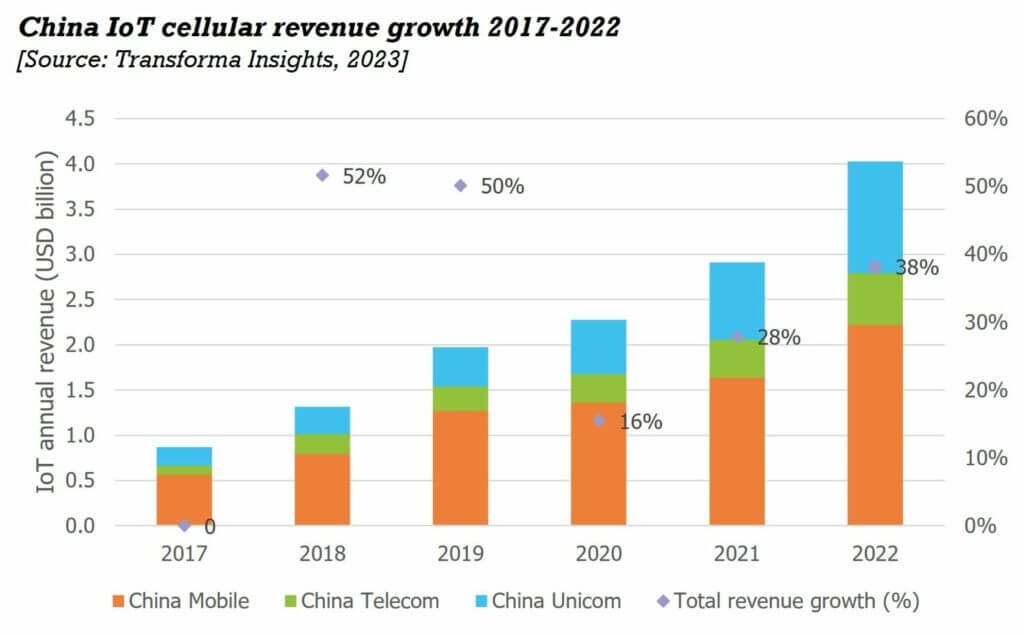

What about revenue? Not as impressive. Collectively the three big cellular IoT operators in China had revenue of just over USD4 billion (CNY28 billion) in 2022, up 28 percent y-o-y. Very big, but in comparison, Vodafone, Verizon, and AT&T are all north of USD1 billion each. And a few others are upwards of USD500m.

Another way to look at it is that China Mobile claims around ten times as many IoT connections as Vodafone, but only around twice as much revenue. And there’s also a debate to be had about the addressable market, but that’s for another time.

The three Chinese MNOs generate very low annual average revenue per connection, at around USD2/year. The comparable figure for the rest of the world in 2022 is around USD10/year. Overall we estimate that China generates only around 1/3 of the global IoT operator revenue.

NB-IoT: A Defining Characteristic of Chinese IoT Connectivity

The reason for Chinese leadership in connections is clear, as is the much lower revenue per connection. The large volumes of NB-IoT are dilutive to the average revenue per connection. Why has China been so aggressive in IoT connectivity? It’s largely political, with the Chinese government keen to drive the success of that particular tech, closely associated with Huawei.

The background is that NB-IoT originated from the Weightless technology developed by UK company Neul, which was acquired by Huawei. As a result, although NB-IoT is part of the 3GPP global standards for mobile communications, it is seen by the Chinese government as being politically ‘their’ technology. The government made available grants and loans for network roll-out, mandated the use of NB-IoT for certain projects, and put pressure on the operators to drive NB-IoT success.

The deployments of NB-IoT have significantly boosted connections figures and slightly driven up revenue, but anecdotal evidence seems to be that there is zero cellular network profit coming from these deployments.

But in this case, and unlike the rest of the world, profit does not seem to be the main motive. It’s also worth noting that perhaps a single development ecosystem is beneficial. Rather than having to contend with technology fragmentation, there is only a single option for low power wide area (LPWA) in China.

What benefit this might give as a short-term push will likely also be a long-term disadvantage, with other technology options being ultimately more appropriate for specific IoT applications, once the initial confusion over options is overcome.

Don’t Be Too Jealous

Operators outside of China should not be overwhelmed by jealousy at the apparent success of their Chinese counterparts. While connections are nominally very high (over three-quarters of global IoT connections if operator figures are to be believed), revenue per connection is very modest, meaning that the IoT opportunity in North America and Europe are each almost comparable with that of China.

If you are interested in the growth of the global IoT market and the opportunity over the next 10 years, watch the webinar ‘Are We Nearly There Yet?: Annual Update On Transforma Insights’ IoT Market Forecasts’ to learn about which applications and verticals will dominate in future, which technologies will be used, which countries will see the biggest growth, and what is the revenue opportunity.

Tweet

Share

Share

- Cellular

- Connectivity

- IoT Platforms

- NB-IoT

- Cellular

- Connectivity

- IoT Platforms

- NB-IoT